Alternatively, In case you have a cosigner with fantastic credit score, this will let you qualify to get a $twenty five,000 own financial loan. Online lenders generally have less stringent necessities than common banks. As a foul credit history borrower, you might want to implement with an on-line lender first.

Although Most effective Egg might demand origination fees, we like that Greatest Egg provides a reasonably superior highest financial loan limit and that you can get your cash as speedily as in the future.

Whenever you narrow down the best lenders, Look at the yearly share charges and utilize the calculator on this site to discover how much different fees will set you back in excess of the life of the personal loan.

A house fairness line of credit rating (HELOC) means that you can tap into the fairness you’ve created up in your home. HELOCs have what’s referred to as a draw interval where you might take out just as much as you want as usually as you want – up for the Restrict set by your lender. Once the draw time period ends, the repayment time period will get started.

2 We get the job done with a few lenders that would not have a need for a credit score Check out and use money and/or work to create choices on eligibility for their economic solutions. Underwriting conditions is established by our partners, not Acorn Finance.

Autopay: The SoFi 0.25% autopay desire level reduction requires you to conform to make every month principal and fascination payments by an computerized monthly deduction from a savings or checking account.

You may pick out "show" to view a timetable of how your month to month payments of principal and curiosity will reduce your equilibrium till your financial loan is repaid. Make use of the "incorporate further payments" aspect to Learn the way having to pay much more towards your principal quickens your amortization routine.

Emily Cahill is usually a freelance personal finance author that is captivated with empowering folks to generate sensible alternatives within their monetary and personal life. Her do the job has appeared in Experian, GOBankingRates and Dollars.com.

Ensure your lender works by using a secure portal and that you choose to don’t do this above community Wi-Fi. If the lender asks for additional data or documentation, try out to deliver it as rapidly as you can to stop processing delays.

Credit rating Rating: A substantial credit rating score signifies to lenders that you are a very low-danger borrower, which might ensure it is easier to acquire a mortgage with favorable phrases.

Your probable fascination level, the size of your mortgage and here any expenses will have an effect on the general Value. We endorse utilizing a personal loan calculator to determine the amount you could finish up paying above the life of the bank loan.

Borrowers submit an application for loans on peer-to-peer platforms and will probable have to undertake usual lending eligibility assessments, such as credit score checks. These loans also commonly come with origination charges, which make your bank loan costlier.

For anyone who is authorised for a private bank loan with Citi, you may get your money exactly the same working day with a Citi deposit account, or around two organization times to get a non-Citi account when applying direct deposit. Or, you'll be able to pick out to get a Look at by mail in somewhere around five enterprise days.

Soon after checking your credit history, it is possible to start to shop around for just a bank loan. It'd be valuable to determine what your lender or credit score union provides, nonetheless it’s best to check potential selections from various lenders so yow will discover the most effective fees and conditions to suit your needs.

Jenna Von Oy Then & Now!

Jenna Von Oy Then & Now! Danny Pintauro Then & Now!

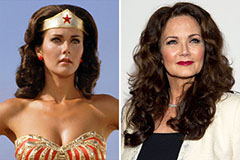

Danny Pintauro Then & Now! Lynda Carter Then & Now!

Lynda Carter Then & Now! Heather Locklear Then & Now!

Heather Locklear Then & Now! Stephen Hawking Then & Now!

Stephen Hawking Then & Now!